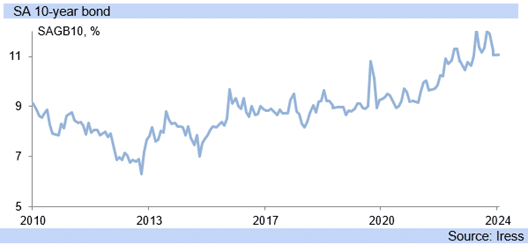

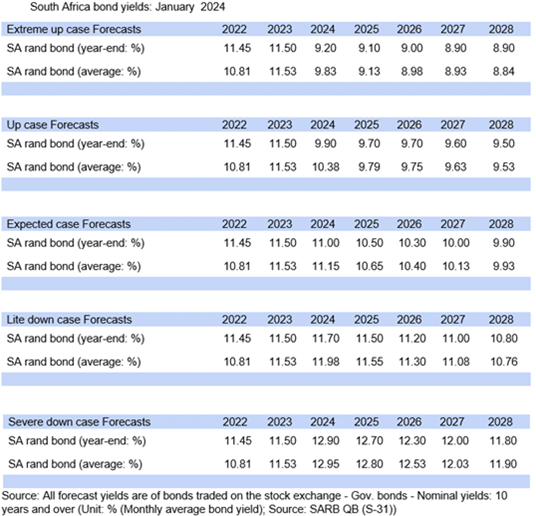

1South Africa’s benchmark (ten-year) government bond has seen its yield remain above 11.00% for most of this year so far and averaging 11.03% after 2023’s average of 11.25%, deteriorated from 2022’s 10.48% as fiscal health weakened.

• Indeed, in 2021, the yield on South Africa’s benchmark (ten-year) government bond averaged 9.40%, and in 2019 8.94%, 2013 7.35% as SA’s long-term borrowing costs rose as the state extended its gross loan borrowings (as a % of GDP).

• South Africa’s steadily rising benchmark yield (inverse relation to the price) over the years indicates the falling value of SA bonds, with yields much lower, and hence the ten-year yield much higher than that of most EM bonds.

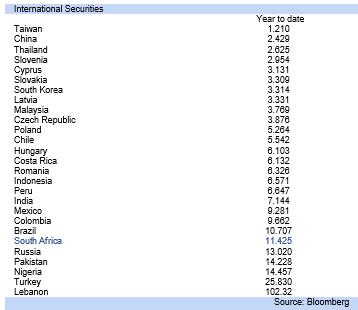

• Bloomberg’s ten-year local currency bond yield ranker for emerging countries’ debt shows that SA ranks among the bottom of the twenty-eight countries included, with only Russia, Turkey, Pakistan, Lebanon and Nigeria seeing higher yields.

• That is, the local currency bonds for SA have a relatively high overall total country risk (as local currency debt includes country risk as well as sovereign risk) compared to other emerging countries’ benchmark bonds.

• The majority of this Bloomberg ranked groups’ yields are below 10%, specifically over twenty-one of the twenty-eight countries, with Brazil’s benchmark bond yield at 10.71%, and South Africa coming in next at twenty-three.

• The extremely poor faring of SA’s government bonds is indicative of the deterioration in the credit quality, with borrowing set to balloon to 74.7% of GDP this fiscal year from 70.9% in 2022/23. It is projected to climb further to 77.5% of GDP by 2026/27.

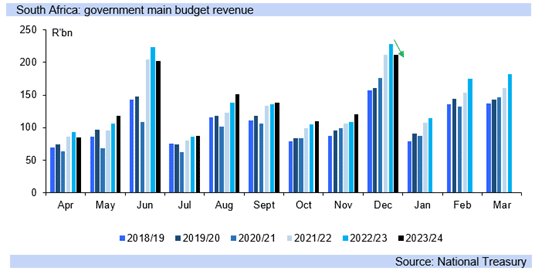

• In the second half of the 2000s the debt was closer to 20% of GDP, while the country’s benchmark bond yield was close to 6%. The most recent government statistics show for the first three quarters of 2023/24 that the revenue underrun continues.

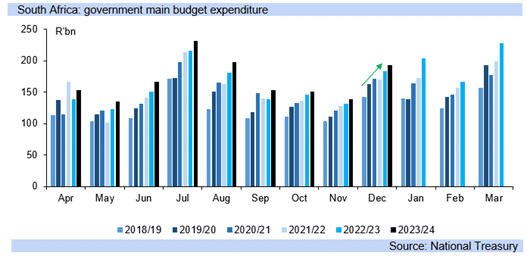

• Expenditure is at 74.2% of the revised budget in the MTBPS, ahead of last year’s 70.1% at this time. Revenue is at 71.5% of budget, under the 72.2% of the comparable period, and underscoring the likelihood of the projected ballooning in borrowings.

The deficit is currently sitting at -R292.2bn for the first three quarters of the year. Gross loan debt as a % of GDP was below 70% prior to 2022/23, and last year saw weak commodity prices and a collapse in growth damage revenues.

• The state continues to overspend this fiscal year compared to the comparative periods of last year, eroding the chance of the country’s gross loan debt coming in substantially below the projected figure, which is undermining bond yields.

• Financial markets react negatively to increased borrowings, particularly when expenditure does not slow to fit the deterioration in revenue, which has been the case for a number of years for SA, causing its yields to jump up, and credit ratings to fall.

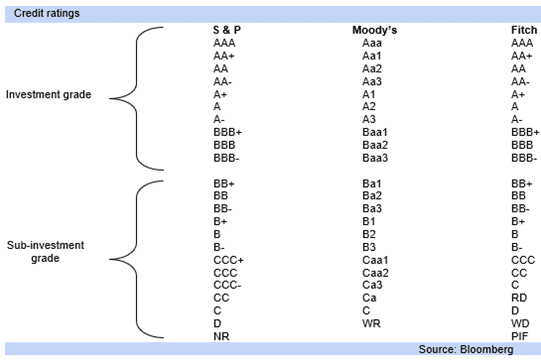

• Lebanon, Turkey, Nigeria and Russia have lower credit ratings than SA, higher benchmark bond yields, with Nigeria and Turkey in the single B category, Pakistan CCC and Lebanon lower at RD, with the bottom rung ratings being seen as ‘junk’.

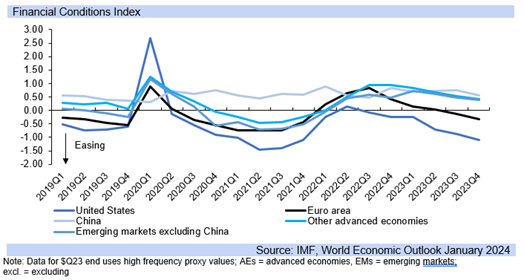

• The IMF highlights in its World Economic Outlook that “(i)n emerging market and developing economies, in which output has on average fallen even further below the prepandemic trend, on average the fiscal stance is estimated to have been neutral.”

• Adding in its WEO (World Economic Outlook) that “(t)he exceptions include Brazil and Russia, where fiscal policy eased in 2023”, with the yield on Brazil’s ten year bond rising from 10.28% in 2023 to 10.75%.

• The IMF adds “(i)n 2024, the fiscal policy stance is expected to tighten in several advanced and emerging market and developing economies to rebuild budgetary room for maneuver and curb the rising path of debt”.

• “Global growth is projected at 3.1 percent in 2024 and 3.2 percent in 2025, with the 2024 forecast 0.2(%) … higher than that in the October …WEO) on … greater-than expected resilience in the United States and several large emerging market and developing economies, as well as fiscal support in China.”

• “The forecast for 2024–25 is, however, below the historical (2000–19) average of 3.8 percent, with elevated central bank policy rates to fight inflation, a withdrawal of fiscal support amid high debt weighing on economic activity, and low underlying productivity growth.”